We're investing in our communities

LPEA pays our members back when they implement certain energy efficiency and beneficial electrification measures in their homes and businesses.

NEW! We’ve added an Income-Qualified option to help support the Colorado Energy Office's new HEAR program. All Income-Qualified rebates are available to members with their primary residence (>50% of the year occupied) in LPEA’s service territory.

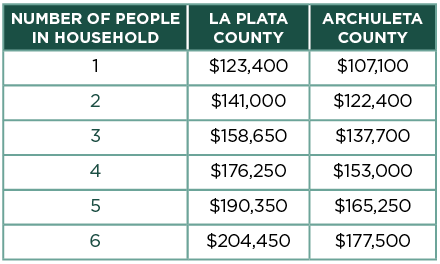

Income Limits Overview

Based on gross income up to 150% of Area Median Income (AMI)

We know the cost of living is pretty high around here, so the income limits are also higher than you might think, up to 150% of the area median income (AMI).

PLUS, here's more information on how electrification can boost efficiency and lower your bills.

Learn About Going Electric

View Federal Tax Credits

Learn about the HEAR Program

For details and application forms for each rebate program, click the corresponding box below. If you are income-qualified, check out each program for additional rebates and assistance opportunities.

Rebates, and combinations of rebates, amounting to more than $500 in the same month, will require a signed and complete IRS W-9 form for the member/rebate recipient. A W-9 is kept on file by LPEA as proof of the allocation of funds. Any tax liability is the responsibility of the rebate recipient. View W-9 Guide here.

The Standard Rebate tier has an annual per-member cap of $1500 (excluding Batteries)

The Income Qualified Rebate tier has an annual per-member cap of $3000 (excluding Batteries and All-Electric Bonus)

All rebates must be submitted within 90 days of the latest date either:

- purchase

- completed installation

- or certificate of occupancy (new construction).

Questions? Contact LPEA’s Energy Management team at rebates@lpea.coop or (970) 247-5786.

Get More from Your Energy Rebates in 2026!

Our energy experts are here to help you maximize your savings.

Join us for free one-on-one guidance on:

✓ Available rebate programs

✓ Budget planning for energy projects

✓ Personalized recommendations for your home

Drop in anytime during the session, no appointment needed.

Whether you have specific questions or just want to explore your options, we're here to help!

March 3 | LPEA Pagosa Springs Office

11:30 AM - 1:30 PM

April 8 | LPEA Durango Office

8:00 AM to 9:30 AM

11: 30 AM to 1: 30 PM

May 7 | LPEA Durango Office

11:30 AM to 1:30 PM

4:00 PM to 5:00 PM

Keep an eye out for more sessions!